- Landonline unavailable Saturday 8 August

- Update on CSD processing times

- New automated survey report

- Naming roads over private land

- Recent changes to Authority and Instruction (A&I) forms

- Taxation (Land Information and Offshore Persons Information) Bill

Issue 120

This month, there are a few important reminders, a heads-up about Landonline unavailability, and a message from the head of our Property Rights group.

For surveyors, you can read an update on CSD processing times and learn about our new automated survey report, an optional tool. We also offer a handy hint on naming roads over private land during the subdivision process.

For lawyers and conveyancers, there are proposed changes to property tax legislation that you need to know about, and some small changes to A&I forms.

Also, thanks to all those who recently provided feedback on suggested enhancements to Landonline. We’ll be using your feedback to help prioritise the enhancements we make in our next Landonline release. Keep an eye on upcoming issues of Landwrap for updates.

Landonline unavailable Saturday 8 August

Landonline will be unavailable on Saturday 8 August 2015 so we can carry out our annual disaster recovery test.

LINZ has a disaster recovery system which would replace our primary Landonline system in the event of an emergency. This test is a regular check of our ability to switch to this back-up system to ensure property transactions would still continue in the event of a natural disaster or large technical failure.

The date for this test has been confirmed after an earlier planned test was postponed. It does not make any changes to Landonline.

Update on CSD processing times

Russell J Turner, Deputy Chief Executive - Property Rights, gives an update on LINZ’s work to reduce the timeframes for CSD processing.

LINZ is working to reduce the time it takes to process CSDs.

We've made some progress with this and, thanks to the hard work of the team, CSDs affected by ground movement in Canterbury are now being processed within the same timeframes as other CSDs.

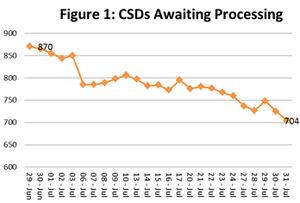

Our statistics also show that in the last month we’ve seen a decrease in the number of CSDs waiting to be processed (Figure 1).

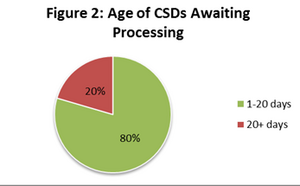

We also now have 80 percent of CSDs waiting less than 20 days for processing (Figure 2), which means that we’re able to move many of them through in less than the 25 to 29 day timeframe.

However, we acknowledge that this is still too long, and 25 to 29 days remains the best estimated timeframe for incoming CSDs. To deal with this, we are continuing to bring on and upskill groups of new staff as fundamentally there is a need to increase these numbers to deal with the level of work.

Our workforce has built their skills over many years of working for LINZ, and so we’ve had to introduce a new approach so that the training we do now is more effective while still maintaining quality. We’re seeing clear benefits from this and it has sped up our training times for individuals. However, as LINZ’s work is specialised, there is a need to take experienced staff out of work to train and develop new staff and this does impact on timeframes in the short term.

This work is necessary and so I appreciate your patience throughout this time. We’ll update you on our progress as we continue to work on this and as we explore the other steps we can take to reduce the processing time of CSDs.

Russell J Turner, Deputy Chief Executive – Property Rights

New automated survey report

With the Landonline 3.11 release, we introduced an Automated Survey Report. This is an optional tool. Since it was released we’ve had some feedback from you on some issues with the report and so we’ve made the following changes to resolve these.

Boundaries defined by Adoption auto response question

When a vector is captured as “Adopted” the Survey Report identifies it as being a boundary. This occurs regardless of the captured “Purpose” for the mark. As a result, surveys containing non- boundary marks only were incorrectly reporting boundaries as “Defined by Adoption”. The radio button showed “Yes” and could not be changed, requiring a mandatory comment.

This issue has been resolved and the system is now correctly testing for the “Mark Purpose”. The surveyor needs to comment as to whether there are boundary marks captured as “Defined by Adoption”. They should manually check that marks have not been inadvertently captured as “Defined by Adoption” before completing the comments field. Note that under the RCS 2010 the mark purposes “Defined by Adoption”, “Defined by Survey” and “Accepted” apply only to boundary marks and should not be used for non-boundary marks.

Non-Primary Parcels – Existing Easement and Covenant questions

Currently the wording of the Existing Easement & Covenant questions in the Non-Primary Parcels section is unclear and causing some confusion.

The Yes/No responses against these questions will be removed. The questions will also be split to cover Existing Easements & Covenants to be retained and surrendered, with fields for surveyors to add comments:

Any plans in progress (in workspace or requisitioned) will need these new questions addressed to complete the survey report.

Only one survey report should be attached to a CSD

If you use the Automated Survey Report, you don’t need to attach your report as a supporting document (SUD). The report is automatically created and attached when you submit your CSD. If you attach an additional report, Landonline will discard the automated report and use the manually attached document.

Read more about how the automated survey report works (//www.linz.govt.nz/kb/699)

Determining lodgement fees without submitting dataset

We know there are still some issues with this, and you’re not able to view fees prior to submitting. We’ll fix this through our next Landonline release. In the meantime, you’ll find information on how to view fees on the known issues page.

Find information about fees on the known issues page (//www.linz.govt.nz/land/landonline/landonline-releases-and-system-updates/known-issues/known- issues-for-e-survey)

If you have feedback on the automated survey report please email kmarshall@linz.govt.nz (mailto:kmarshall@linz.govt.nz)

Related Content

Automated Survey Report (/kb/699)

Naming roads over private land

Assigning addresses to newly subdivided parcels is an important part of the subdivision process. Surveyors need to be aware that in many cases roads formed over private land need to be named early on in the subdivision process.

The Rural and Urban Addressing Standard (AS/NZS4819:2011), that came into effect in 2011, is used by Territorial Authorities (TAs) when allocating addresses and naming roads. LINZ is responsible for ensuring TAs follow this standard to ensure that the properties can be easily identified and located.

As well as the requirement for naming public roads, the standard requires that some private roads also need to be named. This affects the numbering of the properties that use these roads. A private road, private way, right of way, or access lot needs to be named if six or more addressable sites are accessed off it - or are likely to be accessed off it in the future.

Surveyors can assist by identifying such roads and confirm any naming requirements with the TA during the resource consent process. By highlighting these early in the subdivision process surveyors and TAs will have plenty time to follow the council road naming process.

Related Content

Addressing standards and guidelines (/regulatory/property-addressing/addressing-standards- and-guidelines)

Recent changes to Authority and Instruction (A&I) forms

We’ve made a couple of changes to the Authority and Instruction forms to clarify what information these need to show.

The words ‘and/or Nominee’ have been added after the ‘Transferee’ label

Because it’s not always clear who will ultimately be recorded as the transferee, the vendor’s A&I form does not record the name of the purchaser(s) or records different purchaser’s names. This recent change allows you to enter a name but also reflects that the Transfer may involve a nomination.

If a nomination takes place, you should keep a clear paper trail as evidence that this has occurred (for example, any subsequent written advice or instructions regarding the nominated transferee/s) along with the A&I forms.

A new footnote has been added to the ‘Notes’ section on the last page of the A&I form

This is to remind you and your staff to keep a copy of both sides of a new NZ Drivers Licence as the new format shows the expiry on the reverse side. i.e. “Attached copies of photo ID must include the expiry date (it appears on the reverse side of the new Drivers Licences)-expired ID may not be relied upon.”

Related Content

Authority & Instruction (A&I) (/land/land-registration/prepare-and-submit-your- dealing/authority-instruction-ai)

Taxation (Land Information and Offshore Persons Information) Bill

An update for lawyers and conveyancers on what they need to discuss with clients under proposed property tax measures.

We’re writing to remind you that the Taxation (Land Information and Offshore Persons Information) Bill being considered by Parliament may mean some changes for your clients.

The Bill aims to help Inland Revenue (IR) enforce property tax rules by amending the Land Transfer Act and the Tax Administration Act. If passed, it would require:

- buyers and sellers of residential property to provide their IRD number and other details when transferring property (there will be an exemption for the main home)

- those with tax residency in another jurisdiction to also provide the equivalent of their IRD number in that country

- offshore persons to provide evidence of a New Zealand bank account in order to obtain an IRD number.

Pending the legislative process, the Bill – and regulations – will likely pass by 30 September. Changes to Landonline would be implemented from 1 October to enable the collection of the required tax information. Without the necessary tax information, you will not be able to submit a new dealing through Landonline.

For this reason, you may want to discuss the need for IRD numbers with clients who may not qualify for an exemption if the Bill passes. Those who may need them for property transfers from 1 October can help ensure the process goes smoothly by:

- having their IRD number at hand – this is often on payslips, and is included on letters and statements from IR. For people who have registered, IRD numbers are accessible through the IR website (link below) and/or IR’s VoiceID service, or

- applying for an IRD number, if they need one.

It’s also likely that Trusts will need a Trust IRD number for property transfers as, under the proposed legislation:

- the Trust’s – rather than individual trustees’ – IRD number must be provided

- if the Trust owns a non-earning property and doesn’t have an IRD number, it will likely need one if it plans to transfer property (whether as transferee or transferor) as individual trustees’ personal IRD numbers aren’t acceptable

- collection of IRD numbers for Trust beneficiaries will likely not be required.

LINZ will continue working with the Law Society, and other groups representing lawyers and conveyancers, to provide updates and guidance on what the Bill will mean for them. We’ll also update

Landonline users about any changes closer to the time.

More information on the Bill is available on the Beehive website, and through the IR Tax Policy site (link below).

Related External Content

- Inland Revenue website (IRD number page) (http://www.ird.govt.nz/contact-us/topfive/one/ird- number-index.html#01)

- Inland Revenue Tax Policy website (http://taxpolicy.ird.govt.nz/bills/51-34)

Media contact

Email: media@linz.govt.nz