Overseas people wanting to invest in New Zealand’s sensitive assets are required to get prior consent through the Overseas Investment Office (OIO). Investors requiring consent are people who are not generally New Zealand citizens or ordinarily live here.

Learn about the process: Apply for consent, variation or exemption

The system balances 3 key objectives.

- Enabling desirable foreign investment by recognising the benefits that it brings to New Zealand. For example, foreign investment can help overcome domestic saving constraints, increase exports, bring more productive and better managed firms to New Zealand, or expertise into existing New Zealand firms, as well as provide spill-over benefits to the local economy such as greater competition, access to overseas markets, and research and development opportunities.

- Addressing public concerns about foreign investment including profits going offshore, loss of ownership, and overseas investors creating social, economic or environmental risks.

- Providing a stable investment environment. Policies guiding foreign investment need to be flexible enough to address domestic concerns that may arise now and in the future, while providing adequate certainty for investors that the ‘rules of the game’ are unlikely to change suddenly.

Who is involved in the Overseas Investment system?

Treasury is the Government’s primary strategic policy advisor on overseas investment.

Toitū Te Whenua’s Overseas Investment Office (OIO) implements the Overseas Investment system, including processing applications, operational policy, service design and enforcement activity. The Chief Executive of Toitū Te Whenua is the regulator of the Overseas Investment Act 2005.

Lawyers and real estate agents play a part in the system. Lawyers advise overseas investors on their requirements (including compliance) under the Overseas Investment system and help them to navigate the application process. Real estate agents identify whether an investor in residential, commercial or rural property is from overseas and therefore requires consent to invest. They often advise the investor to seek legal advice.

Most consent decisions are made by one or a combination of the Ministers of Finance, Land Information and Fisheries, depending on the nature of the sensitive asset. Some decisions are delegated to the OIO.

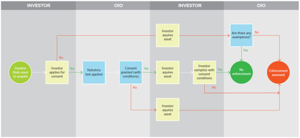

The diagram below outlines the key processes in the Overseas Investment system.