You can prepare a partial discharge/withdrawal in Share/Interest mode in Landonline.

Share/Interest mode is only available for certain instrument types:

- Partial Discharge of Mortgage (PDM)

- Partial Discharge of Encumbrance (PENC).

Mandatory fields are marked by a red asterisk * and must be completed for successful pre-validation, certify and sign, and submission.

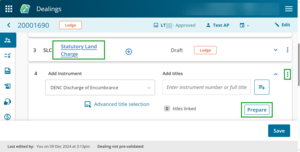

1: Navigate to the Prepare instrument page

To access the Prepare instrument page you can:

- Select the instrument hyperlink to navigate to the Prepare instrument page when an instrument is collapsed.

- Select the Prepare button when an instrument is expanded.

- Select the 3-dot menu at the end of an instruments row and select Prepare instrument.

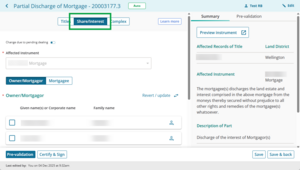

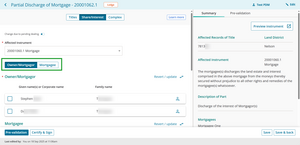

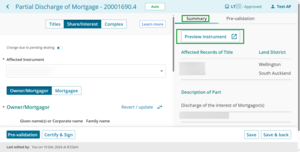

2: Select Share/Interest to change to this mode

Select Share/Interest to change to this mode. For help on preparing in Titles or Complex mode go to:

3: Check the affected instrument number

Check the instrument number is correct in the Affected instrument field. This will pre-populate if there is only 1 relevant instrument on the title.

If the Affected instrument field is blank, use the drop-down menu to select the relevant instrument from the list.

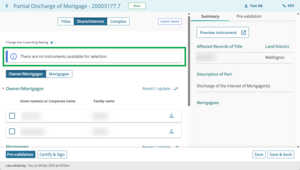

If there are no instruments available for selection, you will see an info banner advising this.

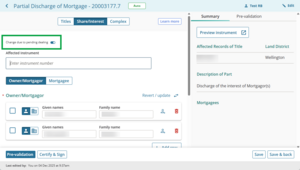

To manually enter an instrument number from a pending dealing, toggle on the Change due to pending dealing toggle.

Enter the instrument number into the Affected instrument field, then press Tab on your keyboard or click anywhere to continue.

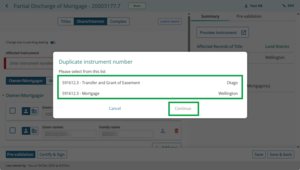

If the instrument you enter has the same number as an instrument in another land district, a Duplicate instrument number pop-up will appear. Select the correct instrument from the list, and then Continue.

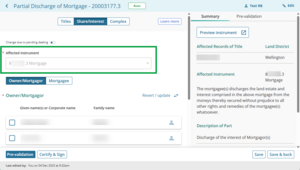

4: Select who you are discharging for

Select whether you are discharging in respect of the share/interest of the:

- Owner, Mortgagor (Encumbrancer)

- Mortgagee (Encumbrancee).

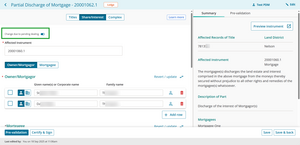

5: Review and choose the owner or mortgagor's names

Select the Owner/Mortgagor button to review the encumbrancers, or interest holders.

Shown will be:

- the names of the registered interest holders, or

- any prior change of ownership instrument already prepared in the same dealing.

If the person icon to the right of the interest holder is filled blue, it means there are additional details for that person. This could be an alias, suffix or the birthdate of a minor. Select the icon to view those details and select it again to hide those details.

Add, edit or delete the interest holder names

Select the Change due to pending dealing toggle above the Affected Instrument to edit, add or delete the names displayed.

For example, use when an instrument in a prior dealing or a prior instrument in the same dealing is changing an interest holder's name.

When Change due to pending dealing is toggled on, you can adjust the display order of mortgagees, however this change only affects the Prepare screen and the Summary – it does not carry through to registration. The display order after registration is determined by the original instrument. So, although you can rearrange them, the order will revert to the original once the instrument is registered.

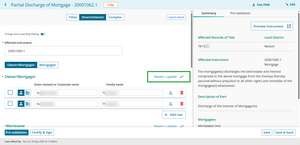

Reset the names

Select the Revert / Update button to:

- reset the names to reflect the Register, or

- update names from any prior instrument in the dealing.

For example, when you select Revert / update;

- if the interest holder details have been edited using Change due to pending dealing, they will revert to what is recorded on the Register

- if a prior instrument has been added to your dealing which changes the interest holder, this will pull through the updated names.

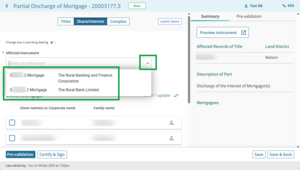

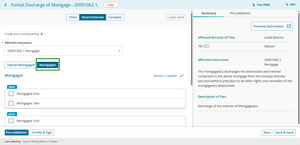

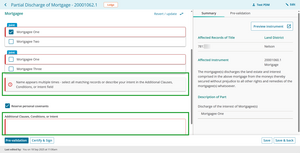

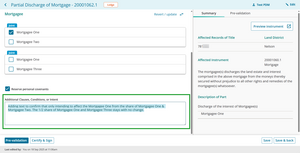

6: Review and choose the mortgagee names

Select the Mortgagee button to review the encumbrancees.

Tick the checkboxes next to the mortgagees you wish to discharge the interest of.

If there are mortgagees with the same name and not all instances of the mortgagee are selected, a warning and the Additional Clauses, Conditions or Intent box will appear.

You'll need to explain the intent for your mortgagee selection in the Additional Clauses, Conditions or Intent box.

Once your intent is entered the warning will disappear and the mortgagee will appear in the Summary, under Description of Part.

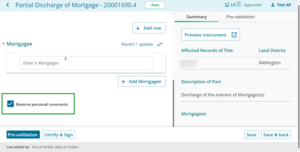

7: Uncheck Reserve personal covenants, if needed

If applicable, when discharging a mortgage or encumbrance, uncheck the Reserve personal covenants checkbox if the parties haven’t made these arrangements relating to the rights and remedies of the Mortgagee/Encumbrancee.

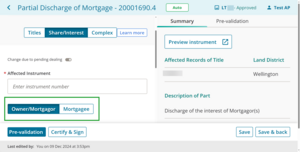

8: Preview the instrument

The Summary tab will automatically update and display a read-only summary of some key details entered on the left-hand side of the page.

Use the Preview instrument button to view, print or download the full Instrument preview, including any add text fields, certifications and signatures.

9: Save the instrument details

Use Save to save the information and remain on the Prepare instrument page.

Use Save & back to save the information and return to the Instruments & Roles page.