When to use Instrument mode

Use Instrument mode to mortgage a mortgage, an encumbrance or other interest, including lease or easement instrument.

More than 1 affected instrument can be mortgaged, except when the instrument number is manually entered. You can only manually enter 1 affected instrument.

If you need to mortgage a mortgage or other interest on titles that don't have common ownership, this can be done using Instrument mode.

Mandatory fields are marked by a red asterisk and must be completed for successful pre-validation, certify and sign, and submission.

Leases

If a Leasehold Title or Composite Title has been created for a lease, use either Simple or Complex mode to complete the mortgage.

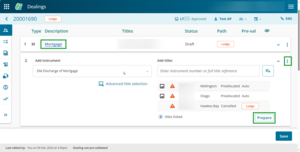

1: Navigate to the Prepare instrument page.

You can access the Prepare instrument page from the Instruments & Roles page. To open the page choose one of the following:

- Select the Mortgage hyper link when the instrument details are collapsed.

- Select Prepare when the mortgage instrument details are displayed.

- Select the 3-dot menu to the right of the transmission instrument. Then select Prepare instrument from the menu.

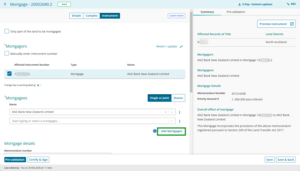

2: Select Instrument to change to Instrument mode.

By default, Simple mode is selected for a mortgage instrument.

Select Instrument mode to mortgage a mortgage, encumbrance or other interest including lease or easement instrument.

The mode type can be changed back to Simple if the mortgage is for all registered owners over all of the affected titles.

Prepare a mortgage in Simple mode

The mode type can be changed to Complex if the mortgage is:

- only affecting part of the land

- when dealing with only some of the mortgagors shares and/or interests on one or more titles,or

- when adding specific conditions or clauses to the instrument.

Prepare a mortgage in Complex mode.

3: If dealing with part of the land, check the Only part of the land to be mortgaged checkbox.

Select the Only part of the land to be mortgaged checkbox if the mortgage is only for part of the land.

Enter the legal description for the part of the land to be mortgaged. The Description of Part field is a free text field and is limited to 500 characters.

Ensure you include all the details required, for example: Part Lot 1 LT12345 formerly comprised in Lot 2 DP6789.

This instrument will step down to lodge if this field is used.

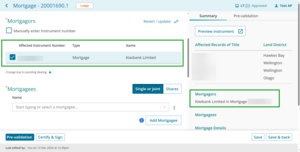

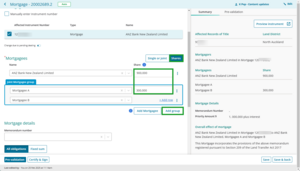

4: Select which instruments to mortgage.

The names of the interest holders will automatically display.

Select the relevant checkboxes next to the affected mortgagors. To affect all mortgagors, select the checkbox next to Joint Mortgagor group.

Review the Mortgagors section in the Summary to check your selections are correct.

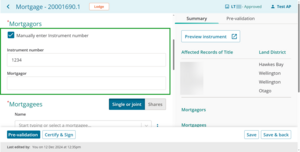

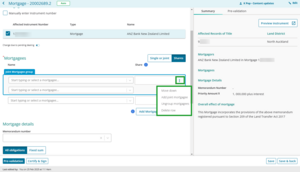

Manually enter Instrument number

You'll need to manually enter an instrument number if the instrument you are affecting isn't listed. For example a lease or an easement, or when dealing with a protected (hidden) instrument.

- Select the Manually enter Instrument number checkbox.

- Enter the instrument number to be mortgaged.

- Enter the Mortgagor name. Use a comma to separate names when there are multiple Mortgagors.

This instrument will step down to Lodge if these fields are used.

When mortgaging a lease, you must manually enter the lease number into the Instrument number field.

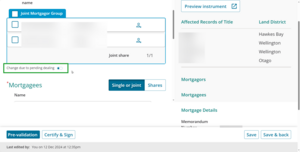

Change due to pending dealing

The Change due to pending dealing toggle under the mortgagors can be used to edit, add or delete the names displayed. For example, use when an instrument in a prior dealing is changing an interest holder.

You will need to confirm you want to modify the names before making any changes.

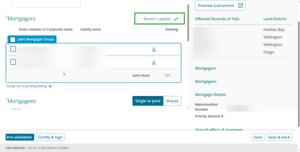

Revert/update

Use the Revert / update button above the Mortgagors section to re-set the interest holder's name to reflect the Register and any prior instrument in the dealing.

For example, if the interest holder's name has been edited using Change due to pending dealing, it will revert to what is recorded on the Register. Or, if a prior instrument has been added to your dealing which changes the interest holder, using Revert /update will pull through the updated names.

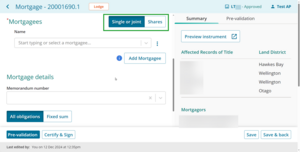

5: Select whether the Mortgagees are Single or Joint or Shares.

By default, Single or joint is selected.

Use Single or joint for 1 or more mortgagees who will hold the mortgage solely or together.

Use Shares where mortgagees will hold the mortgage in shares or amounts.

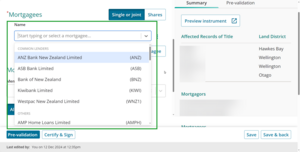

6: Select or enter a Mortgagee.

Use the drop-down menu in the Name field to view a list of common mortgagees that have associated quick codes.

The most common lenders are listed first.

Either scroll down the list or start typing a lender's name to filter the available options.

Add a new mortgagee

For other mortgagees, such as private mortgagees, type the name directly into the Name field.

After entering the name, select it from the drop-down menu to confirm your entry.

Add additional mortgagees, shares or create a mortgagee group

Select Add Mortgagee to add a new mortgagee row.

In Shares mode an extra column appears where you can enter the shares each mortgagee will hold.

You can enter the shares as a number, fraction or dollar value.

You can also select Add group to create a joint mortgagee group, where 2 or more mortgagees hold a share together.

Additional actions – three-dot menu

Select the 3-dot icon to the right of a mortgagee for a menu of additional options such as:

- move mortgagees up or down

- add a new joint mortgagee

- ungroup mortgagees

- delete rows.

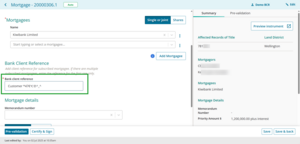

7: Add bank client reference

If the mortgagee is subscribed to Landonline a Bank Client Reference field will appear.

If the field appears you must enter a reference.

Type in the reference into the Bank Client Reference field.

This field is free text. You can enter words, numbers and symbols.

Editing the bank client reference

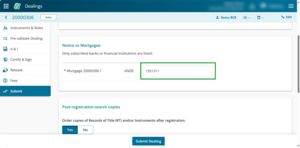

Once the instrument is signed you can edit the bank client reference at the submit stage.

Find the bank client reference in the field next to the mortgagee in the Notice to Mortgagee section of the Submit screen.

Enter changes.

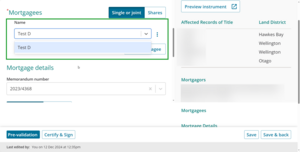

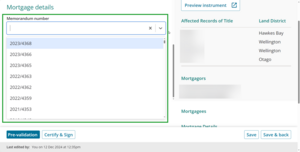

8: Select or enter the Memorandum number.

Select the Memorandum number field to look up a memorandum.

If the mortgagee has specific memoranda these will be listed first, followed by common or generic memoranda such as ADLS.

Either scroll down the list, which is arranged from newest to oldest, or start typing part of the memorandum number to filter options.

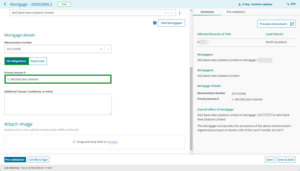

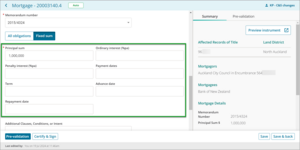

9: Select either All obligations or Fixed Sum and enter required information.

All obligations

By default, All obligations is selected.

Enter the Priority amount for the mortgage. You don't need to add a $ sign and the field accepts both numbers, characters and text.

This is not a mandatory requirement, however, it's commonly used. A pre-validation warning will display if the field is left blank.

Fixed sum

At a minimum you must enter the principal sum amount in the Principal sum field. You don't need to add a $ sign.

Complete the other mortgage details if known.

Fields are free text so you can add any complex interest payment provisions. A limit of 250 characters is set per field.

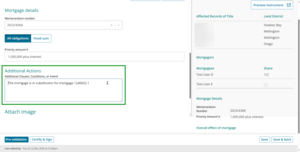

Use the Additional Clauses, Conditions or Intent field to add any further text but note this will cause the instrument to step down to Lodge.

The Summary will automatically update with the wording or you can use Preview Instrument to view the full instrument details.

10: Add text to the Additional Clauses, Conditions or Intent field, if needed.

Use the Additional Clauses, Conditions or Intent field to include additional details, such as supplementary clauses and conditions, or to clarify the intent for the mortgage. This is a free text field.

Ensure you include all the details required.

This instrument will step down to Lodge if this field is used.

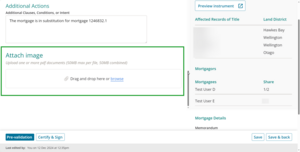

11: Upload an attachment to support the mortgage, if needed.

Use the Attach image field to add PDFs. You can:

- drag and drop a PDF into the Attach image field, or

- select browse and upload a PDF from your files.

There is no limit on the number of PDFs you can attach, but all attachments together must not exceed 45 MB. You won’t be able to save the Prepare instrument page if any or all attachments exceed 45 MB.

Delete one or more attachments until the combined size is 45 MB or less.

You can view attached PDFs by:

- clicking on a PDF

- selecting Preview Instrument to view the compiled instruments and attachments.

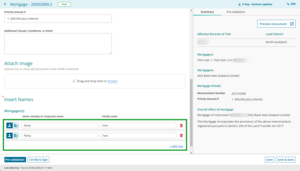

12: Insert names, if needed

Skip this step and go to step 12 if there aren't multiple conveyancing professionals acting for a single role. The Insert Names section will be hidden if this is the case.

If you've manually entered the instrument details and there are multiple conveyancing professionals acting for a role, for example, where there are 2 parties to an easement which have separate representation, use the Insert Names section to add the names of each separate party.

This allows the conveyancing professional to select which party they're representing when making their certifications during the certify and sign process.

By default, individual fields are selected.

Select the corporate icon to add a corporate name.

Select +Add row to add another name.

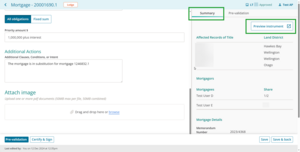

13: Review the Summary and preview the instrument.

The Summary tab will automatically update and display a read-only summary of some key details entered on the left-hand side of the page.

Select Preview instrument view, print or download the full instrument preview, including any added text, attachments or certifications and signatures.

The instrument preview might take time to load if you have attached PDFs. This is because it needs to compile the structured data with the attachments.

14: Save.

Select Save at the bottom right of the page to save the information and stay on the Prepare instrument page.

Select Save & back to save the information and return to the Instrument & Roles page.